Mortgage Investment Corporation

A Mortgage Investment Corporation (MIC) is a type of investment vehicle that pools money from multiple investors to invest in mortgages and mortgage-related assets.

A Mortgage Investment Corporation (MIC) operates as an investment entity that specifically focuses on investing in mortgage loans. It is established as a corporation or trust according to applicable jurisdictional laws, with the primary aim of generating income from the interest payments made by borrowers on these mortgage loans. To secure the necessary funds for investment, the MIC raises capital by issuing shares or units to interested investors. The funds raised determine the size and scope of the mortgage portfolio that the MIC can create and manage.

Here's how a Mortgage Investment Corporation typically works

Structure

A MIC is structured as a corporation and is typically managed by experienced professionals.

Mortgage Portfolio

The MIC uses the funds raised from investors to originate or purchase a portfolio of mortgages.

Regulatory Requirements

MICs are subject to specific regulations and must comply with securities laws in the jurisdiction where they operate.

Liquidity

MIC shares are generally illiquid, meaning they are not easily tradable on a public exchange.

"Secure Your Financial Future with Our Mortgage Investment Corporation"

A Path to Profitable Real Estate Ventures

Overview of Mortgage Investment Corporations (MICs)

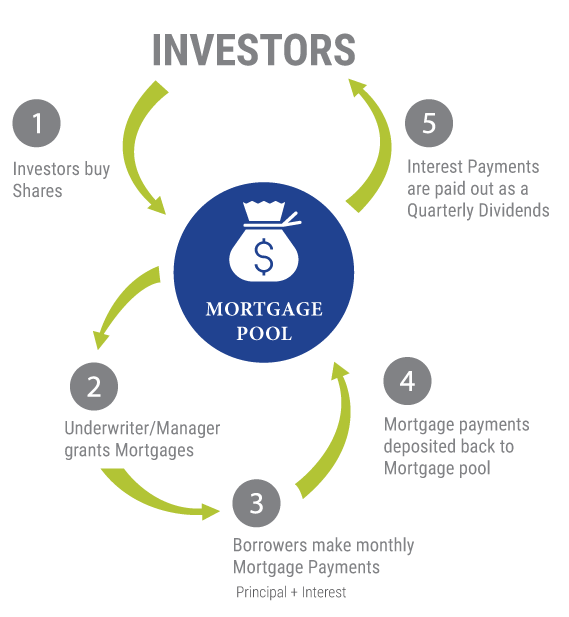

- A group of investors invest by buying shares of the MIC.

- A borrower or their broker who wants to buy a property approaches the MIC.

- The MIC qualifies the borrower by various parameters such as appraisal, income qualification and credit worthiness.

- If the mortgage is approved, it is funded with pooled investor funds and your money starts working.

- The MIC receives monthly payments from the borrowers.

- The MIC receives monthly payments from the borrowers.

- The interest received from the borrowers is paid back to the investors quarterly in the form of dividends.